photo courtesy of Wikimedia Commons

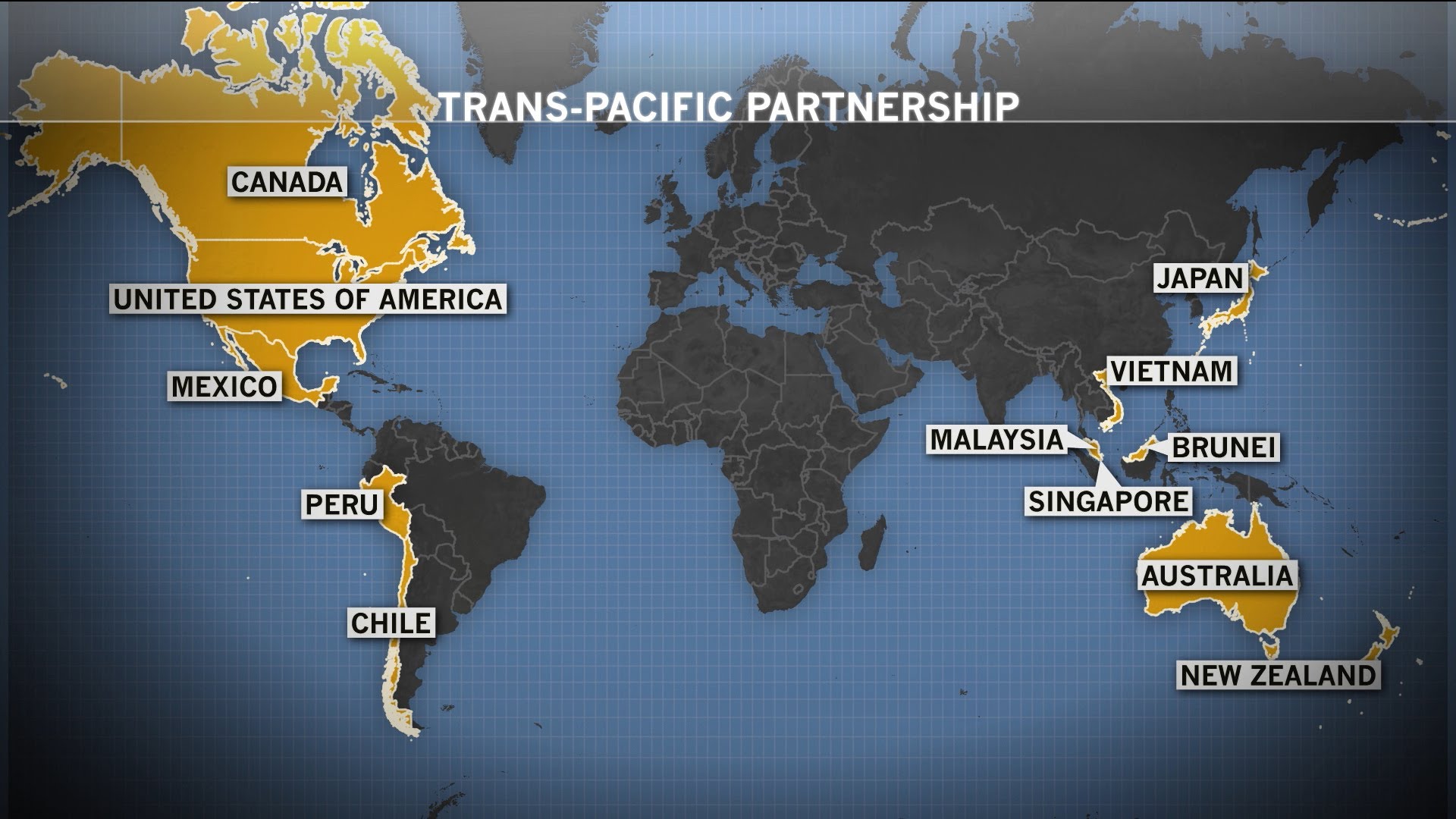

The Trans-Pacific Partnership, or the TPP, is a two million word trade agreement that aims to create a more fluid and open market in the Pacific region by removing tariffs (taxes on imported goods) and trying to create a level playing field. The countries involved are the U.S., Japan, Malaysia, Vietnam, Singapore, Brunei, Australia, New Zealand, Canada, Mexico, Chile, and Peru. These countries make up over 40% of the world economy.

What would the TPP do?

Remove tariffs (and other nontariff barriers) to allow nations involved in the agreement to sell products in other nations without needing to price the product high enough to cover a tariff. The TPP would remove 18,000 tariffs imposed by other countries on goods from the United States, theoretically increasing U.S. exports. However, U.S. businesses would also lose protection on imports from other countries.

Labor standards would be set at the same level in all participating countries. This includes precluding child labor, setting minimum income requirements and more. The standards would improve the quality of life of workers as well as make sure no country has an unfair price advantage because they are willing to subject their workers to inhumane or dangerous working conditions.

Government Procurement will be open to all member states of the TPP. This means that a firm from any country could submit a bid for a government contract from any government in the TPP.

Intellectual property and patents would be more strictly enforced in participating countries. For example, patents for prescription drugs and copyrights for film characters would be easier to control abroad. Since much of the U.S. economy stems from intellectual property, analysts predict this would largely boost our economy. However, critics argue that this would hinder fair use as well as innovation. Drawing inspiration from copyrighted or patented property would present legal hurdles. Frivolous patent lawsuits may increase and cheaper generic drugs would take much longer to come to market.

Digital trade would be promoted, the rules would be clarified, and cybersecurity would be enhanced. The TPP would prevent the involved countries from looking at proprietary source code created in other countries. This will ensure security of private messaging algorithms, and prevent government backed clones of American software. It also ensures security of VPNs and encryption, as well as making sure data can flow rapidly without cost between countries.

State Owned Enterprises (SOEs) would be required to compete fairly with private enterprises. This would prevent governments from giving preferential treatment to their own enterprises (such as contracts or better interest rates), something that is prevalent and sometimes integral to the SOE’s business. It is worth noting that the United States does not have as many state owned enterprises compared to other countries in the TPP. Things like the Postal Service, Freddie Mac, and Fannie Mae (government finance institutions) don’t comprise much of our economy or exports. Many other countries’ state-owned enterprises make up a significant portion of their economy, and will be forced to compete fairly with private enterprises which may initially burden their economy.

Transparency and anticorruption would be promoted by the TPP. It ensures everyone has easy access to rules and regulations, forcing countries to enforce anti-bribery laws and promoting the integrity of government officials (through reporting of bad behavior, discipline, etc).

Investor State Dispute Procedures is one of the most controversial clauses that many countries (like Australia) have objected to and is still the subject of debate. It allows companies to sue governments if the government is not abiding by the TPP rules or deliberately harming foreign companies’ business. Critics believe the threat of lawsuits will scare countries away from regulating companies and protecting things like the environment or public health, for example. Governments are still trying to tweak the procedure to protect regulators’ rights since currently there is a lot of potential for companies to abuse the system. Analysts cite the hypothetical example of an American tobacco company suing the Australian government if they pass legislation banning tobacco advertising or an American poultry company suing a European government for banning the sale of poultry washed with chlorine (a process legal in the United States but not in Europe).

photo courtesy of Earth Day Network

How the TPP affects U.S. businesses:

U.S. firms would have to compete with foreign companies. With the absence of tariffs, foreign goods can be priced the same as domestic ones. This could present a problem for companies which have less expertise or experience than foreign ones. While previously able to compete with price, their lower quality product would be priced as the same higher quality ones from abroad. Some say this will increase unemployment in the U.S. However, American companies would have the opportunity to compete abroad, using their expertise and experience to sell goods elsewhere. While Japan may be better at making cars, the U.S. may be better at making movies. Most economists agree that letting each country focus on their strengths and freely sell their goods in foreign markets creates more value than protecting weak businesses. The Peterson Institute for International Economics predicted a 9% rise in exports and a $131 billion rise in total annual household income due to the TPP. The U.S. International Trade Commission forecasted an increase of 128,000 jobs (albeit with an initial period of job churn – people moving jobs).

How it affects consumers:

Consumers in the participating countries would see product quality rise and price drop. Since foreign goods can compete with U.S. goods price wise, not only would there be extra competition, but countries with specialties (such as Canadian maple syrup) would be able to sell their high quality products in the U.S. for much cheaper (since there are no tariffs).

How it affects China:

China is not included in the TPP. Thus, they would not receive the same advantages that many of its neighboring countries would. Their products would still be subject to tariffs and other barriers when they export to America. The TPP has widely been seen as an effort to put a damper on China and decrease U.S. reliance on them. At a press conference, Obama said, “we can’t let countries like China write the rules of the global economy.” Economists predict that the TPP will slow China’s economic growth and decrease the amount of Chinese imports into the U.S.