California’s minimum wage is set at $10.00 per hour. In San Francisco, workers can expect to make a minimum of $13.00 an hour. However, by 2022, the California minimum wage is set to jump to $15.00. While San Francisco and Los Angeles had already implemented minimum wage hikes, with a San Francisco $15 minimum wage expected to be established in 2018, this move is unparalleled on a statewide level.

is semester, I embarked on an independent study with statistics teacher Mariel Triggs. After taking an introductory course in microeconomics, I set out to research the effects of this minimum wage spike on California. In addition to the MIT microeconomics course, I studied relevant employment and demographic details of California and analyzed a litany of studies looking at the effects of higher minimum wage and the elasticity labor demand in various industries, comparing them to the nuances of California’s economy. I also broke down the information by county, as there are stark differences between the economics of a city like San Francisco and rural communities like Kings County. I will now share some of my main takeaways.

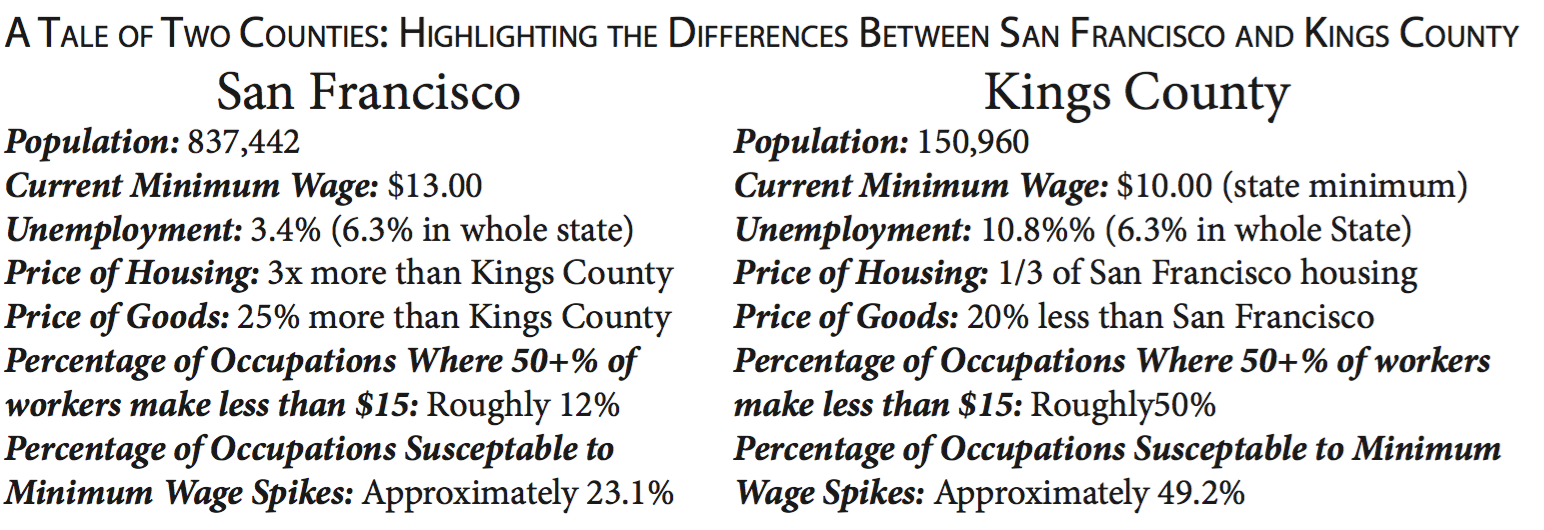

In looking at the numerous studies that have researched mini- mum wage increases, most studies have concluded that the net effect on employment has been minimal. While employees may layoff some workers, expand automation practices, and increase prices to cope with the higher costs, there are other factors that help the economy and improve unemployment. With more workers making more money—over a third of California workers would get a raise—they spend more, which stimulates the economy and allows for businesses to hire more workers due to increased demand for their goods. In a compilation of 1,068 observational studies—compiled by two Greek economists of studies done worldwide—roughly two thirds were found to have negative effects on unemployment with statistical significance (meaning there’s a less than ten percent chance the results were negative by chance). Roughly 30% of studies found increases in unemployment with a minimum wage that were statistically significant. The remaining studies produced results that couldn’t be determined to be positive or negative with any statistical significance.

However, the average elasticity (see Figure 1 graph) of the 734 United States studies was roughly -0.1, which means that for every 1% increase in minimum wage increase, there is about 0.1% decrease in employment. While this doesn’t sound like much, a jump from $10 to $15 an hour equates to about a 5% decrease in demand for employment, not factoring natural job growth.

However, the average elasticity (see Figure 1 graph) of the 734 United States studies was roughly -0.1, which means that for every 1% increase in minimum wage increase, there is about 0.1% decrease in employment. While this doesn’t sound like much, a jump from $10 to $15 an hour equates to about a 5% decrease in demand for employment, not factoring natural job growth.

Many have criticized these studies for inaccuracies, citing small sample sizes and a lack of effective control variables, among other factors, as concerns. Probably the most comprehensive study of the minimum wage looked at employment effects on counties on the border of states with differing minimum wages. is is a more accurate way to determine if changes in minimum wages will lead to unemployment, as the counties had similar employment demographics. The 2007 study, led by UC Berkeley professor and a staunch supporter of the $15 minimum wage Michael Reich, concluded, “Our local estimators are more robust and show no employment effects.”

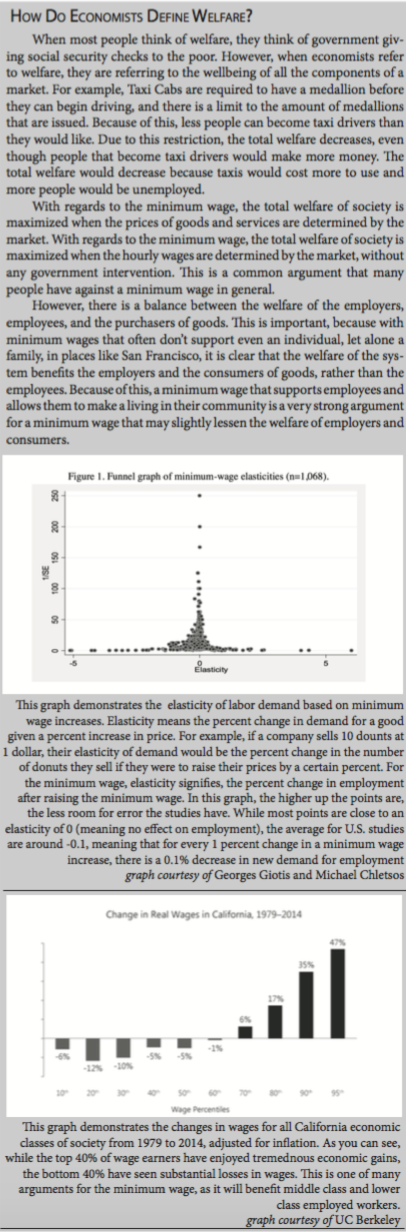

However, a 2006 review of minimum wage studies done by UC Irvine professor David Neumark and Federal Reserve Board Member raised concerns for specific groups and industries that are negatively affected with wage increases. They noted that teenagers and uneducated workers almost always suffer in response to an increased minimum wage—as more educated and experienced workers would be willing to work minimum wage jobs—with blue-collar workers and the retail industry also negatively impacted. White-collar workers actually see a boost in employment per their review, suggesting that companies shift their employment away from manual labor in response to a higher minimum wage. Small businesses—which employ half of the California private work force—are a particular concern. While companies like McDonald’s can pay their employees $15 an hour and only raise the price of goods by a few cents to cover costs, smaller companies will have to raise their prices by a more substantial margin or decrease their employment if they don’t receive an increase in business.

Regardless, a minimum wage increase of 50% is unparalleled and has never really been thoroughly researched. Recent data from Seattle, which raised its minimum wage to $15, has shown little to no adverse effects in employment, but Washington’s state miimum wage remains at $9.47. However, in a state with many rural communities like California, concerns linger for how local businesses will adapt to the wage spike.

In San Francisco, the cost of living is incredibly high. According to the Living Wage Calculator, a mathematical model created by MIT professor Amy Glasmeier, an individual living in San Francisco must make $14.80 an hour ($30,777 per year) to earn a living wage. With a single parent supporting a child, that gure jumps to an astounding $31.21 ($64,921 annually). is is a result of the high costs for taxes, hous- ing, transportation, health care, food, and other basic needs. In Kings County, California, where the cost of housing is nearly a third of that of San Francisco and goods are roughly 20% cheaper, the living wage estimate is closer to $8.00 an hour for an individual supporting themselves. While San Francisco’s workers need to earn roughly $15 an hour to just support themselves, in a rural community like Kings County, a $15 wage goes alot further.

Other statistics highlight the drastically different economics of San Francisco County and the state’s rural regions and raise valid concerns for businesses in these types of rural areas. According to a breakdown by data scientist Ben Casselman, in Visalia-Porterville, the largest city in Tulare County, adjacent to Kings County, roughly half of all workers currently earn less than $15 an hour, and 48.7% of occupations employ half or more of their employees below $15 hourly. In San Francisco, approximately 12% of occupations employ half or more of their employees below the proposed $15 minimum wage. In San Francisco, this will mostly affect the fast food industry and other typical low-wage jobs. In more rural areas, more typically lower-middle class jobs will receive a wage spike, and the effects will also be felt in the agricultural community.

Certain industries are more prone to decreased employment from a higher minimum wage. The retail, agriculture, and restaurant industries, among others, have more adverse effects on employment with a higher minimum wage, whereas government jobs and most types of manufacturing, among other jobs, are less susceptible to a minimum wage increase. In 2004, Israeli professor Leif Danziger broke down the effects on employment by industry with an increased minimum wage. Looking at the employment demographics of Kings County from the Bureau of Labor Statistics and comparing them to this study reveals that 49.2% of employees work in industries that are negatively a ected by minimum wage increases. In contrast, 23.1% of San Francisco jobs are in these problematic industries. In addition, the Bureau of Labor Statistics also projected 10 year job growth in Kings County in 2012—before the decision to raise the minimum wage to $15—and roughly 53.1% of projected new jobs are in industries where the average workers make below the minimum wage. These sorts of drastic changes in the average wage highlight the uncertainty and discomfort that looms from a $15 minimum wage in these communities.

Given these concerns, some detractors of a $15 minimum wage have proposed different solutions in order to provide workers with a living wage. Billionaire investor Warren Buffett publicized the alternative of overhauling and expanding the Earned Income Tax Credit system, in which you file your income taxes and receive a government check based on your wages. This system, which many economists have also proposed, needs to be corrected to allow for monthly payments and to avoid fraud and corruption, but many view it as a superior option to drastically increasing the minimum wage. The burden shifts from businesses to the taxpayer, but a 2005 study done by Georgetown professor Nada Eissa, amongst other studies, indicates an increased level of employment in response to an increased Earned Income Tax Credit. While the idea needs to be further researched to determine if it is worth the taxpayer dollars, it addresses many of the concerns highlighted by people on both sides fighting for and against a higher minimum wage.

In the end, I believe a $15 minimum wage will be beneficial to the San Francisco community. While teen and fast food employment may slightly decrease, the total employment is not particularly vulnerable to changes in minimum wage and could slightly increase or decrease as a result of a higher minimum wage. San Francisco’s economy is similar in many ways to Seattle, who has yet to experience any adverse effects from their $15 minimum wage. The social security system will take on fewer costs as well, as those employed at minimum wage are more capable of supporting themselves at a living wage. However, I have some fears for Kings County and other rural regions in California. In places where unemployment is over 10% and the cost of living is very low, a 50% minimum wage increase has the potential for negative repercussions, especially because these places are also dominated by low wage labor and industries that have responded negatively to higher minimum wages in the past. Costs will undoubtedly rise, and employment will likely see some declines as well.

In the end, I believe a $15 minimum wage will be beneficial to the San Francisco community. While teen and fast food employment may slightly decrease, the total employment is not particularly vulnerable to changes in minimum wage and could slightly increase or decrease as a result of a higher minimum wage. San Francisco’s economy is similar in many ways to Seattle, who has yet to experience any adverse effects from their $15 minimum wage. The social security system will take on fewer costs as well, as those employed at minimum wage are more capable of supporting themselves at a living wage. However, I have some fears for Kings County and other rural regions in California. In places where unemployment is over 10% and the cost of living is very low, a 50% minimum wage increase has the potential for negative repercussions, especially because these places are also dominated by low wage labor and industries that have responded negatively to higher minimum wages in the past. Costs will undoubtedly rise, and employment will likely see some declines as well.

I conclude that while the net effect on unemployment will be minimal in California, the rural communities of California are at risk to suffer from more unemployment. In these places, costs are already low, and a $15 minimum wage will significantly a effect the payrolls of many local businesses and entire industries. While I can’t definitively claim that the effects will be very negative and deny the benefits of an increased minimum wage, I think for now, the minimum wage of $15 is not in the best interest of rural regions like Kings County. However, it’s important that we continue to research the effects of a higher minimum wage and to explore promising alternatives, especially considering an expansion of the Earned Income Tax Credit. As of now, only time will tell.