Students at Lick-Wilmerding High School have raised questions about the school’s $70 million endowment such as: How is it managed? By whom? Where is the money invested? Why? And more. The endowment, which has been a part of the institution since its founding, helps to fund the school’s endeavors, especially in the form of Flexible Tuition.

“We’re very fortunate, for a San Francisco school we have a sizable endowment,” LWHS Chief Financial Officer (CFO) Jeanette Moore said. This size helps subsidize the LWHS operating budget and provides the funds for Flexible Tuition. LWHS has around a $30 million yearly budget, and about $2.6 million of it comes from the endowment. “It really helps us to run the school. You know, it’s not solely for our financial or flex tuition program, but without it, we wouldn’t be able to have a flexible tuition program at the levels that we have,” Moore said.

All school endowments are limited as to how much can be taken out each year by the Uniform Prudent Management of Institutional Funds Act (UPMIDA), which was adopted by California in 2009. LWHS uses about 4% of its endowment every year. “The goal is you keep the corpus of the endowment in place and continue to grow it so that you can support generations to come of Lick students,” Moore said.

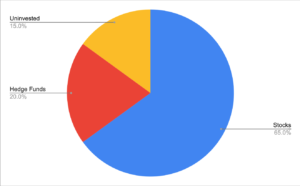

LWHS cannot use much of the endowment due to UPMIDA, but it can use the interest the endowment generates. In order to grow the size of the endowment, the money is first invested in a variety of places. LWHS’s target is to have 65% of the endowment in equity-oriented investments (stocks and private companies), 20% in diversifying strategies (hedge funds and real estate) and 15% in fixed income (bonds and cash that is left uninvested).

graph by Tessa Fastiff

Because of the current high inflation rates, money that is passively sitting in a bank will generate a lot due to high interest rates. This means that LWHS can put its money in safe investments like government bonds and receive high interest which can go into the school’s operating budget.

To manage its portfolio, LWHS outsources its Chief Investment Officer (CIO) to a company called TIFF. TIFF is an asset management firm. Their website states, “our primary objective is to enhance investment returns for our members while also optimizing their costs and reducing their administrative burden.”

LWHS outsources its CIO role for a few reasons: it would not make financial sense for LWHS to employ someone to be an investment advisor, and Moore’s expertise is not picking stocks and securities. This outsourced investment advisor CIO model is very common. “[TIFF] is a company: this is what they do. They are very good at picking managers and understanding what’s going on the market” Moore said. “We really hire them for their expertise.”

TIFF’s management even goes down to the participatory aspect of owning stocks which includes voting on measures put up to the shareholders. They are acting on LWHS’s behalf. Moore hopes they are participating and voting on measures up to investors even though LWHS’s stock amounts may not be enough to make a difference.

TIFF’s investments on behalf of the school are managed by the investment board at LWHS. The board is made up of the Head of School, CFO, board members and advisory members. It is responsible for monitoring the CIO (in this case TIFF), and overseeing the Investment Policy Statement. The statement is a policy that guides the board and provides a framework for how LWHS invests. It does this by outlining the Board of Trustees role, the investment committees role, TIFF’s role and the target percentages of stock versus fixed income.

The Investment Board meets with TIFF employees quarterly and are updated on how the markets are doing and how/where TIFF is investing LWHS money.

The Board’s role includes approving the spending rate (percentage we can take from the endowment), reviewing and approving the Investment Policy Statement and being updated by the Investment Committee on the performance of the investments. “We have an amazing group of board members and advisory members on our board and this (investing) is what they do for a living and they provide us great advice on all of this. So we’re really lucky to have those partners to really help oversee our endowment,” Moore said. This is an advantage of a private school like LWHS, where some parents have experience and are successful in the financial industry and can offer expert advice as parent volunteers.

LWHS does not directly invest its funds; that is TIFF’s job. This makes divestment, the process of taking stocks out of mainly fossil fuel and gun companies challenging. About 2.5% of the endowment is invested in fossil fuels ($1.7 million) while around 0.01% is in firearms ($7,000). LWHS environmental co-chair, Sophie Lee ’24 said “We don’t have a huge amount of money invested in fossil fuels so divesting won’t have a huge impact. But the reason that we want to successfully divest Lick’s money from fossil fuels is more about living in alignment with Lick’s core values.” Although divesting would align the endowment with LWHS’s ideals, it would not actually create much change.

Although the efforts to manage the endowment and all the places the money ends up in can be complicated, the endowment’s purpose is quite simple. As Moore said, “the endowment is really to provide money to help run the school and to protect future generations.”